what is an open end credit plan

With revolving credit you can use the line of credit repeatedlyup to a certain credit limitfor as long as the account is open. If the plan provides for a variable rate that fact must be disclosed.

Open Banking An Ecosystem That Furnishes The End User With Data From A Labyrinth Of Financial Institutions Via Application Programming Interfaces Apis Apis

There are three types of credit accounts.

. With an open-end mortgage borrowers take a loan for the maximum amount they qualify for. Open loans dont have any prepayment penalties while closed-end loans do. Ad Life Changes Fast.

An open-end credit plan in which the employee receives a lower rate contingent upon employment that is with the rate to be increased upon termination of employment is not a variable-rate plan. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR. Ad Its Easier Than Ever to Compare Debt Services Find the Best Solution for You.

In a Nutshell. Reduce Debt W BBB AFCC Accredited Debt Consolidation Companies. 5 The term new credit plan means a new account under an open end credit plan as defined in section 103i of the Truth in Lending Act or a new credit transaction not under an open end credit plan.

Closed pension funds can be further classified into. Open-ended mortgages function like your credit. When you lease a car youll usually be offered a closed-end lease.

One of the most common types of credit accounts revolving credit is a line of credit that you can borrow from freely but that has a cap known as a credit limit on how much can be used at any given time. The choice of which type of credit to use will ultimately come down to why you need to borrow money and how flexible your purchase and repayment needs are. Advantages of Open Credit.

Open pension funds are custodians of at least one pension plan with no membership restriction. 1 1000 for failure to pay the minimum payment within five days of its due date. The best perk of open-end credit is its flexibility.

Open ended vs. See interpretation of this section in Supplement I. This arrangement provides a line of credit rather than a lump-sum loan amount.

Open-ended mortgages give homeowners the flexibility to use the equity invested in their homes as a source of credit. But with nonrevolving credit you can borrow the amount only once. The finance charge is assessed as of the date credit is extended.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Closed pension funds support pension plans that are only open to specific employees. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

Model clause b is for use in connection with other open-end credit plans. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Subpart AProvides general information that applies to both open-end and closed-end credit transactions including definitions explanations.

The different types of credit. Sample G-24 includes two model clauses for use in complying with 102616h4. 45-12-1026 defines a Flex loan plan as a written agreement subject to this chapter between a licensee and a customer establishing an open-end credit plan under which the licensee contemplates repeated noncommercial loans for.

R Credit and Debit Related Terms 1 The term card issuer means A a credit card issuer in the case of a credit card. A line of credit is a type of. Nonrevolving credit is also known as installment credit.

Related member pension funds. Nows the Time to Put a Powerful Credit Plan in Place with TransUnion. Both forms of debt have their advantages and drawbacks.

Model clause a is for use in connection with credit card accounts under an open-end not home-secured consumer credit plan. A IN GENERAL--In the case of any consumer credit transaction secured by a first mortgage or lien on the principal dwelling of the consumer other than a consumer credit transaction under an open end credit plan or a reverse mortgage for which an impound trust or other type of account has been or will be established in connection with the. In other words if you try to make a payment other than the exact monthly payment youll be charged a fee if you.

Revolving installment and open. In a closed-end lease the leasing company takes on the risk of any additional depreciation. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a property is purchased.

1 Regulation Z defines open-end credit as consumer credit extended by a creditor under a plan in which 1 the creditor reasonably contemplates repeated transactions 2 the creditor may impose a finance charge from time to time on an outstanding unpaid balance and 3 the amount of credit that may be extended to the consumer during the term of the plan. The Flexible Credit Act defines a flex loan as an open-end credit plan. However open-end mortgages are a less common type of home loan.

Open-End Credit vs. A summary of the Credit CARD Acts key provisions with immediate impact on credit card issuers follows. Regulation Z is structured accordingly.

In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible. Any agreement to open an account under an open end consumer credit plan under which extensions of credit are secured by a consumers principal dwelling which is entered into after the end of the 5-month period beginning on the date on which the regulations prescribed under subsection a become final. Get Score Planning Report Protection Tools Now.

And the account is closed permanently after its paid off. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully. Open-end credit is not restricted to a specific use.

An open-end mortgage is also sometimes called a renovation loan. Open-End Credit Pros and Cons. Triggered Terms 102616 b.

Section 101c of the Credit CARD Act adds Section 148 to TILA. They can borrow against that amount as needed then pay down the balance. 2 050 minimum finance charge on balances less than 3334.

Variable-rate plan rates in effect. The Section establishes new requirements for changes in interest rates on credit cards under open-end consumer credit plans. If the terms of a credit card account under an open end consumer credit plan require the payment of any fees other than any late fee over-the-limit fee or fee for a payment returned for insufficient funds by the consumer in the first year during which the account is opened in an aggregate amount in excess of 25 percent of the total amount.

Membership or Participation Fees. Your Credit Can Too.

Pin By Kathryn Q On Cones Lane Workbook In 2022 End Tables With Storage Shopping Sale Seabrook

How To Get Over Debt Shame Debt Managing Your Money Money Saving Tips

Pin By Andre Domeni On Annual Appeal Ideas Lettering Lettering Design Xmas Letter

Hurry Up Credit Card Supportive Grab The Opportunity

United Kingdom Tv Licensing Utility Bill Template In Word Format Utility Bill Bill Template Templates

Github Muhammederdem Credit Card Form Credit Card Form With Smooth And Sweet Micro Interactions Bar Graphs Interactive Credit Card

Common Small Business Loans Visual Ly Small Business Loans Business Loans Small Business Finance

Browse Our Example Of Law Firm Business Development Plan Template Startup Business Plan Marketing Plan Example Business Plan Template Free

Small Business Accounting Checklist Pinterest Small Business Marketing Bookkeeping Business Small Business Bookkeeping

Credit Google Tech Info How To Plan Messages

Miss Me But Let Me Go Funeral Poem Lost Loved One Poem In Etsy Funeral Poems Let Me Go Let It Be

Paying Your Debt Can Be A Challenging Job And It Requires Money Management In Other Word Paying Off Credit Cards Credit Card Payoff Plan Business Credit Cards

Browse Our Example Of Law Firm Business Development Plan Template Startup Business Plan Marketing Plan Example Business Plan Template Free

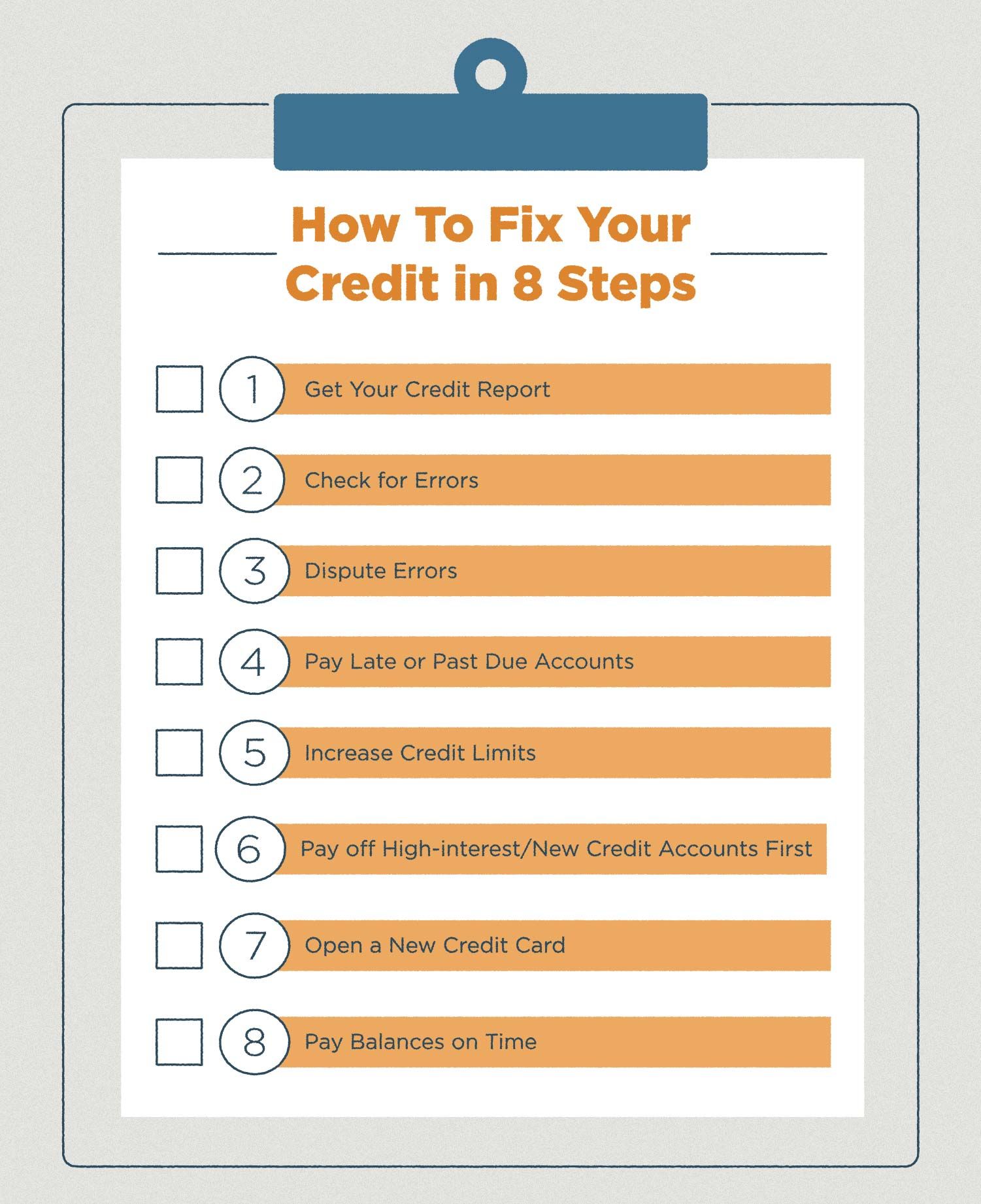

How To Fix Your Credit 11 Steps To Try How To Fix Credit Fix Your Credit Fix My Credit

Tips On Nyc Hop On Hop Off Bus Tours New Bus Tours Infographic

Infographic How To Choose Products To Sell Online Things To Sell Online Infographic Ecommerce Marketing

Chase Year End Summary Statement Chase How To Plan Summary

Investment Banking Company In Usa 1 914 318 9427 Investment Banking Investing Investment Companies

Mazuma S Year End Business Accounting Checklist Mazuma Small Business Accounting Bookkeeping Business Small Business Bookkeeping